Here’s a table comparing the various savings and cash-parking options mentioned in the Reddit thread you’re viewing, focusing on interest/returns, maximum caps, and unique pros/cons. This collation is based on details and testimonials from readers in the thread.

| Provider | Returns p.a. | Maximum | Notes |

|---|---|---|---|

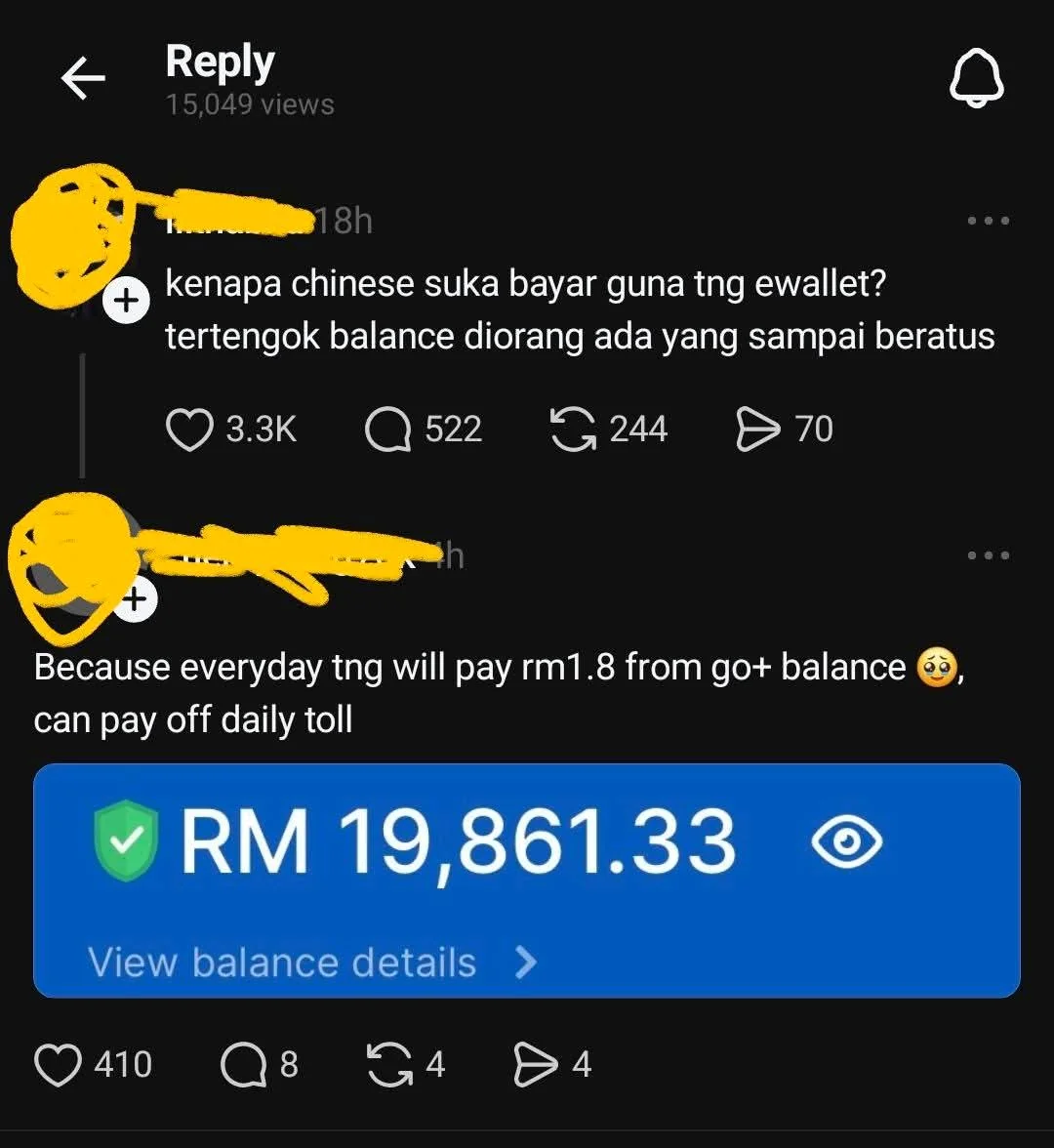

| TNG Go+ (via CIMB Principal) | ~3.2–3.3% | RM20,000 (may vary by user) | Fast withdrawal, convenient for daily expenses, not PIDM-insured, WalletSafe insurance add-on (extra RM6 for 25k protection), risk of unauthorised transactions reported, some users wary about security. |

| CIMB Principal Direct | Similar to Go+ | Higher than TNG Go+ | More secure if accessed directly; withdrawal not instant (up to a week); direct MMF investment. |

| GXBank | ~2% | N/A | PIDM-insured, digital bank, daily interest, some reports of unauthorised charges, safer than e-wallet. |

| EPF (Employees Provident Fund) | ~5% avg | RM250,000 PIDM cap | Highly secure (government), less liquid, retirement/long-term savings. |

| ASB/ASM | ~4–5% | Varies; Bumiputra/ineligible | Relatively liquid, lower risk, restrictions for non-Bumiputra, not instant withdrawal. |

| Atlas by Bank Muamalat | 5% (promo, ends Oct 2025) | RM 50,000.00 | Daily interest, PIDM-insured, instant withdrawal up to RM10k/day, campaign with points/rewards. |

| KDI Save / Versa Cash | ~4–4.11% | Unspecified | Quick withdrawal (1–2 working days), competitive digital bank rates, PIDM-insured. |

| Boost Bank | 3.3% | N/A | Digital bank, instant withdrawal, PIDM-insured. |

| Moomoo (Eastspring income/cash+) | ~4–5% | RM 100,000.00 | Fast access, MMF, PIDM-insured, app-based, has promotions. |

| UOB One Account | First 50k @ 2%, 50–100k @ 6% (efr ~4%) | RM 100,000.00 | Higher effective rate if criteria met (bill pay, monthly deposit), tiered interest structure. |

| AEON Bank | 3% | N/A | Digital bank, instant access, app-based, PIDM-insured. |

| Al-Rajhi | 3% (50k) | Unspecified | Bank account, instant use, PIDM-insured. |

Leave a Reply